Investing in Deep Tech and QuantumAI

A Fireside Chat on Deep Tech and QuantumAI with QAI Ventures’ Michael Jackson and James Sanders

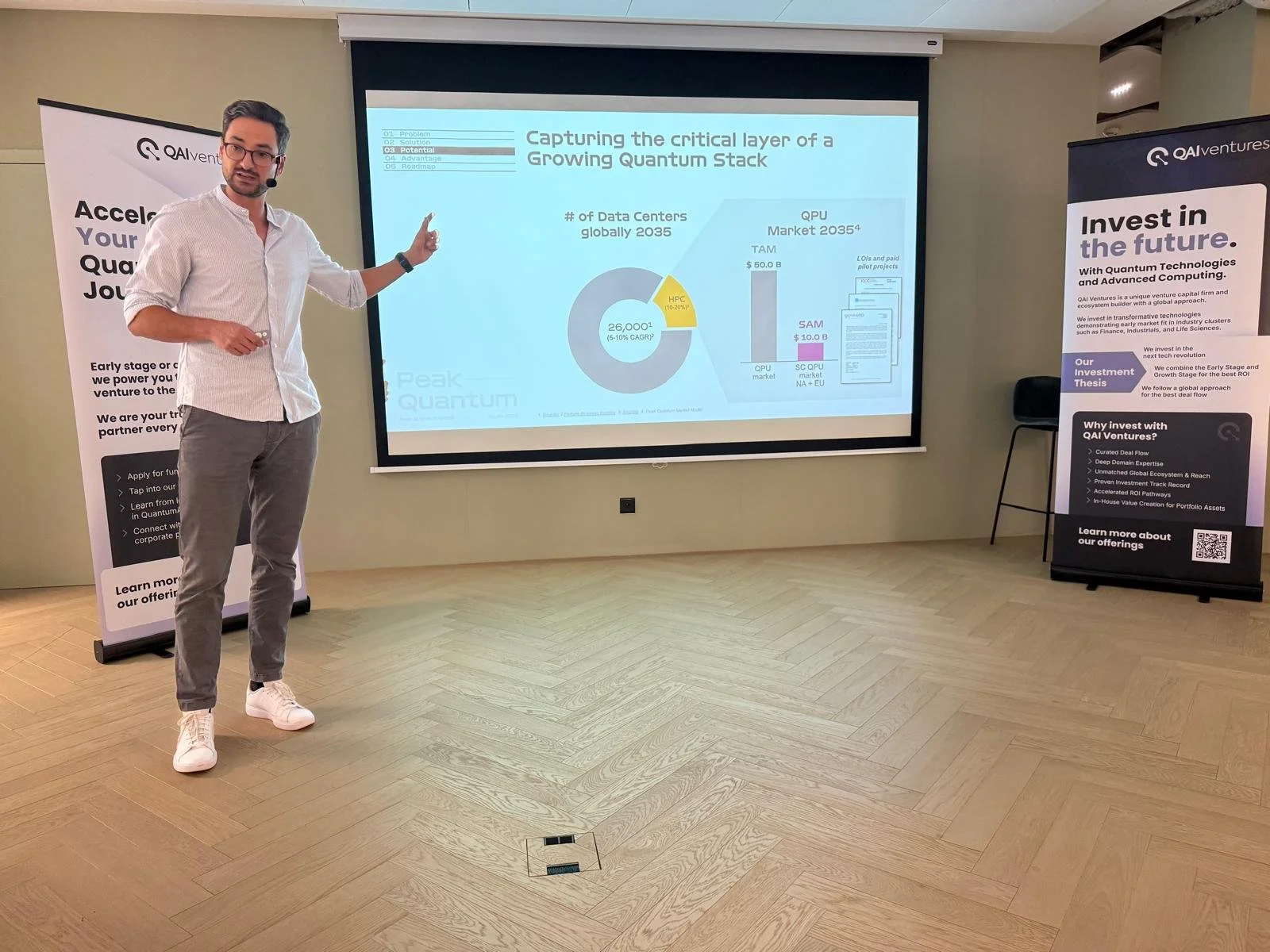

During QAI Ventures’ Investor Day 2025 in Zurich, attendees gathered at Trust Square for a thought-provoking conversation between James Sanders, Investments Director at QAI Ventures, and Michael Jackson, one of the firm’s General Partners. Together, they explored the evolution of deep tech investing, the momentum building around quantum technologies, and Europe’s unique role in this emerging landscape.

Michael, who began his career as a deep tech entrepreneur in the U.S., brings an exceptional global perspective. After spinning off a company from Princeton and selling it to Fidelity, he went on to lead venture and private-equity investments across Silicon Valley and Europe – deploying over $3 billion into advanced-technology ventures. His candid insights set the tone for an engaging and insightful discussion.

James Sanders, Investments Director at QAI Ventures, is hosting the Fireside Chat, introducing Michael Jackson, General Partner at QAI Ventures, to the audience.

Quantum’s Moment: From Hype to Opportunity

Asked whether quantum technology is still hype or finally real, Michael offered a pragmatic perspective:

“All deep tech sectors go through hype. The hype is good, it’s necessary. Quantum today is where AI was 10 to 15 years ago.”

While quantum research has existed for decades, commercial applications are just beginning to take shape. He compared today’s environment to AI’s early years, when investors were still learning to separate vision from value. Deals such as Oxford Ionics’ acquisition reflect this inflection point, echoing how Google’s purchase of DeepMind signalled AI’s coming of age. These deals indicate the beginning of large-scale corporate engagement – a pattern that typically precedes exponential growth.

Michael Jackson and James Sanders are discussing the role of QuantumAI in deep tech Investment at Q QAI Ventures’ Investor Day 2025 in Zurich.

Europe’s Deeptech Landscape: Strength in Science, Gaps in Scale

Why does Europe, despite its world-leading universities and R&D institutions, still struggle to scale deeptech companies at the same pace as the U.S.? Michael attributed it to structural differences in venture capital ecosystems and fragmentation across markets.

“European venture funds are smaller and often backed by public money. Their KPIs focus on job creation and visibility. In the U.S., LPs are pension funds and family offices – purely financial players – so the incentives align around returns.”

This fundamental difference shapes everything from round size to investor risk appetite. While U.S. startups can routinely raise nine-figure Series B or C rounds, European founders often hit a ceiling before achieving scale. The result is fewer unicorns and more premature exits – often to U.S. acquirers with deeper pockets.

Michael also pointed to the fragmented regulatory and capital environment in Europe: “Each country has its own public funding programs, policies, and investor networks,” he said. “It’s not one market, it’s 27.” For deeptech startups tackling long R&D cycles and capital-intensive development, that complexity can be a real barrier to global competitiveness.

Yet, he emphasized, Europe’s scientific output is world-class, particularly in quantum physics, photonics, materials science, and AI research. The challenge lies not in the innovation pipeline, but in commercialization and growth capital, bridging the gap between the lab and the market.

Public Funding: A Double-Edged Sword

Government support can be a powerful catalyst for early-stage innovation, especially in deeptech, where long R&D cycles and high technical risk often deter traditional investors. Public grants, subsidies, and institutional co-investments have helped many European startups get off the ground—but they come with trade-offs.

“Non-dilutive funding is great,” Michael said. “But once governments take equity, the strings can get messy.”

He recalled instances where political agendas interfered with business outcomes, from forced IPOs to blocked acquisitions based on national interests rather than strategic fit. In some cases, public shareholders imposed geographic restrictions or hiring quotas that limited global expansion.

“Your job as a founder isn’t to drive economic development, it’s to build a successful company,” Michael noted. “Governments can be great partners, but only if they act as customers or co-funders, not as gatekeepers.”

This tension is particularly visible in Europe, where public institutional capital – from national development banks to EU programs – accounts for a large share of venture funding. While these programs help derisk early R&D, they rarely provide the follow-on growth capital needed to scale globally.

Quantum Investment Strategy: Building Across the Ecosystem

For investors evaluating the quantum sector, Michael sees opportunity across both hardware and software, and stresses the importance of diversification: “There won’t be a winner-takes-all hardware model. Each platform will serve distinct use cases. The smart strategy is to build a balanced portfolio.”

While quantum computing dominates headlines, other verticals, such as quantum sensing, communications, and encryption, are already achieving commercial traction. These adjacent domains are proving more immediately monetizable, particularly in defense, aerospace, and cybersecurity, where early contracts are validating the technology’s potential.

“Every deeptech wave has started with security and defense,” Michael noted. “From transistors to semiconductors to AI – each major technological leap was first commercialized through defense applications. Quantum will follow the same path.”

Beyond defense, financial institutions and insurers are exploring quantum’s potential to transform encryption, data integrity, and risk modeling. As quantum hardware matures, these industries will likely be among the first large-scale adopters – driven by the need for post-quantum security and faster, more precise computation.

Michael emphasized that investors should think of quantum not as a single sector but as a multi-layered ecosystem: spanning hardware platforms, enabling software, and industry-specific applications. The winners will be those who can connect these layers into scalable, interoperable systems.

That’s precisely the philosophy behind QAI Ventures’ investment strategy. By investing across the quantum value chain – from hardware startups and algorithm developers to applied AI and advanced computing solutions – QAI Ventures builds synergies between research, application, and adoption. This approach not only diversifies exposure but also accelerates market validation and industrial collaboration, two critical ingredients for early product-market fit.

Talent and Timing

A critical bottleneck remains: talent. “Quantum isn’t like building an app,” Michael explained. “There are maybe 20–25 universities globally with real quantum programs.”

The scarcity of skilled quantum engineers, physicists, and applied scientists means that human capital – not just financial capital – is the defining constraint on the sector’s growth. Startups are competing with major tech giants, government labs, and defense agencies for the same small pool of experts, making recruitment and retention a long-term strategic challenge.

Unlike more mature tech sectors, quantum requires deep interdisciplinary expertise, combining physics, materials science, computer science, and systems engineering. That complexity creates a steep learning curve, and it also makes geographical proximity to research ecosystems – like Oxford, Delft, or MIT – an advantage for startups building cutting-edge teams.

“The quantum talent pool is incredibly shallow,” Michael noted. “That’s why investors need to double, triple, even quadruple down on the teams that prove they can execute.”

For QAI Ventures, building around this constraint means leveraging its global network of hubs in Basel, Calgary, Tokyo, and Singapore to connect founders with top research institutions, national labs, and early industrial adopters. By anchoring in key innovation clusters across Europe, North America, and APAC, the team helps founders access talent where it exists and scale solutions where demand is strongest.

Ultimately, depth, not breadth, will define the winners in quantum and deeptech. The companies that secure top talent early, foster strong academic partnerships, and integrate business scalability into their R&D culture will be the ones to lead the next decade of technological transformation.

Michael Jackson shares his advice for deep tech investors before bringing the QAI Ventures’ portfolio startups on stage.

Advice for New Deep Tech Investors

To close the discussion, James asked for one piece of advice for investors new to deep tech. Michael’s answer was characteristically direct:

“Don’t try to understand it. If you do, it’s probably not deep enough. Focus on the team, the market, and their ability to sell. The best science doesn’t always win – the company that gets contracts first does.”

Investor Day 2025: QAI Ventures’ Portfolio Companies pitching in Zurich

Are you an investor interested in the QuantumAI space?

QAI Ventures is a global VC investing in pure Quantum Tech, solutions at the intersection of Quantum and AI, and Advanced Computing Technologies. We act as lead investor, co-lead, or participant in our startups' funding rounds. Our position as an ecosystem connector adds value for all those involved. We work with LP’s and Co-investors.

Learn more about our investment thesis and portfolio on our website or reach out for a 1:1 conversation with James Sanders, QAI Ventures' Investment Director.